From Fleeting to Enduring: Japanese cherry blossoms at a traditional market give way to the crane and Matsu pine trees, symbols of longevity

Patrick L. Springer, DALL-E2

Japanese Equities:

New Ways for Japan Alpha Creation Will be the Next Wave

March, 2024

Patrick L. Springer

A summary version of this report, titled "Japan's Market Boom is Just Getting Started. 2 Big Reasons", was published in Barron's Magazine and the Barron's Website on April 6, 2024 at:

https://www.barrons.com/articles/japan-stock-market-topix-boom-f2651061?mod=past_editions

Key Points –

- Japan’s thirty-four-year trek in the wilderness of deflation ends with the reversal of its Negative Interest Rate Policy, but the end is just the beginning. Consistent with Japan’s intra-year history, a Spring profit-taking splurge may be likely given the 16% and 41% rally year-to-date and from one year ago. But we make the case for a multi-year Japan market revival that will bring a major new capital markets cycle as Japan corporates celebrate a long-awaited return of pricing power supported by an enamored global investor base.

- Next Leg of Japan’s Rally - Structurally different from the mega-cap driven US equity market, the largest companies in Japan are not so magnificent such that investors will be compelled to diversify out of Japan’s top 40 names, constituents that have barely changed in 30 years. Now in full view, long-running inefficiencies in Japan’s market structure become an opportunity, with government and TSE policies the catalyst to incentivize investors to go down the market cap chain. For the many investors who have never seen inflation, wage growth, and domestic sales gains in Japan, mid and small cap stocks will represent a true alpha opportunity.

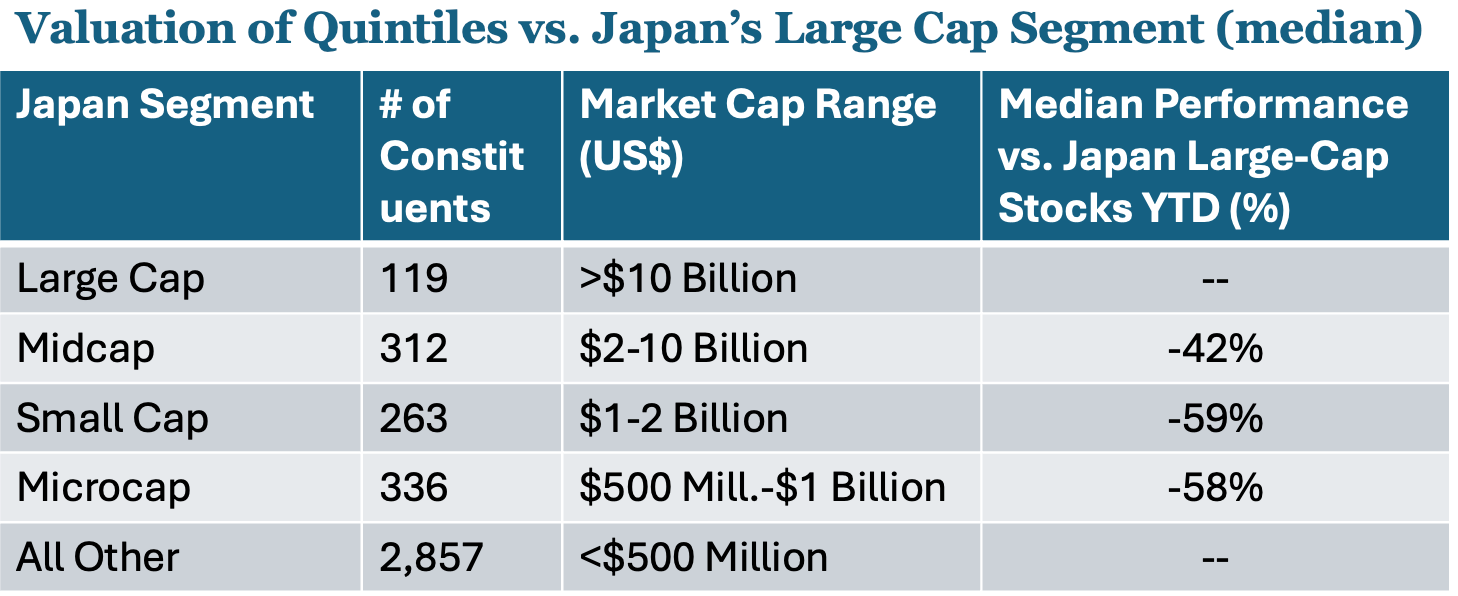

- A Japan “discovery universe” of mid and small cap stocks have underperformed large caps year-to date by 42% and 59%, creating a “universe of companies to investigate - We analyze Japan’s market by quintiles and identify a swath of companies that global investors and also Japanese individual investors, powered by NISA retirement account incentives, should appreciate.1 For example, we think investors will be interested in many ideas with interesting characteristics like this:

- A $2 billion market cap water treatment company that trades over $60 million a day and counts TSMC as one of its key growth customers (Organo Corp (6368 JP))

- A $1.5B dental equipment and precision tools maker that grew sales 23% YOY last year, trades at 8* earnings, sports a 2.5% yield, a 24% ROE, and has 12% of its stock price in net cash (Nakanishi Inc (7716 JP))

- An outsourced software testing services company that has grown it sales and operating income 44% and 60% per year, respectively, since 2019 and trades over $100 million per day (Shift Inc (3797 JP))

- A global top 3 maker of Marine paints that has a 20% global share (60% in Japan), a 15% ROIC, sells at <11* earnings and has a 2.6% dividend yield (Chugoku Marine Paints (4617 JP))

- We screen and find nearly 100 companies with a market cap above $1 billion with negative debt / net cash equal to 20% or more of its stock price

- Inherent Innovation + No More Deflation = A New Wave of Capitalizations – Investors revisiting Japan for the first time since before COVID are appreciating Japan’s clean and orderly cities and the country’s inherent drive to innovate - or re-innovate - in ways that just seem different from everywhere else. “Cool Japan” continues, and a more vital business sector and optimistic Japanese consumer will accelerate that image. With the tailwind of a competitive currency at a wide range of Y135-150/$, new and existing companies alike will come to the market to fund new and specific expansion plans that many investors will reward.

- Our favorite Japan Drivers for Overweight Investment Anxiety - Almost as large as the perils of deflation itself, institutional investors have a thirty-year-long engrained anxiety about having a full market weight position in Japan. But we contend that many will move to a structural above-benchmark Japan position for the first time, quite different from short-term tactical ones. New micro and macro forces are at work to make Japan a preferred non-US destination for at least the next 3-5 years.

- Not Without Risks, but so much change – As a longtime Japan investor, we share with you Japan’s traditional intra-year volatility and key risk scenarios long-term. But what’s most important for investors to realize about Japan is how much has changed there, and amidst a changing world.

Details:

Japan’s TOPIX index year to date and one- year rally of 16% and 41%, respectively, is a focus for investors who have a hard time finding great bull rallies in markets outside the US. While recent record highs on the Nikkei is of interest, what’s really important is the bank of Japan’s full removal of its negative interest rate policy, signaling Japan’s return to a normal macro environment after 30 years of deflation. More than a full generation of investors has passed since Japan had normal economic conditions, so we focus on investor issues that we think will drive the next chapters of Japan’s new story.

Japan’s Market Structure Provides an Opportunity

In the US, mega caps and the Magnificent 7 Rule the world, but inefficiencies in Japan’s equity market combined with an inflation expansion will drive renewed interest in new ideas. In Japan, decade after decade, the list of Japan’s largest companies has barely changed, and among Japan’s forty largest, it is challenging to find more than a single company that was founded later than 1960, and that is just Softbank, founded as far back as 1981. Investors will move down to lower capitalization stocks for the following three reasons:

First, Japan’s equity market is the third largest after the US and China, but according to Abrdn Investments, 45% of Japan’s TOPIX Index of 2000 constituents have no analyst research coverage, vs. just 3% of the Russell 3000 universe for the US.2 Investor relation departments of some companies seeking to expand their investor footprint compensate third party research companies to write research about them, an expanding business in Japan1. Wellington Management and other firms have written about the implications of this lack of coverage, the most salient is that earnings surprises and inflections of under-researched companies lead to significantly higher alpha capture opportunities.3

Second, investors have been piling into companies that have responded positively to the Tokyo Stock Exchanges request to provide specific plans (or just the intention to consider doing so) to increase shareholder value. But this is only 34% of total companies listed.4 This will all be an iterative and reiterative process over the next several years, and there will be arbitrage opportunities as companies embrace or resist the new policies driving the market. Combined with the demographic of aging company managements, we are hopeful that this leads to a reorganization across Japan’s listed companies. We think this means active strategies will have a clear opportunity to perform.

Third, ROE Enhancement opportunities are up for debate – for such an inefficiently researched market, the implications for ROE improvement in Japan will be interesting. Japan’s current ROE is widely estimated to be about 9.5%, up from 4.5% at its bottom more than ten years ago, and different market strategists look for Japan to achieve a 12-13% ROE in the next 2 years, roughly in line with the world average.

But will that ROE target be right? For a country experiencing inflation for the first time in thirty + years, how much will top lines and margins grow? As wages increase, how different might Japan consumer and corporate spending be? Japanese households have about $135,000 in average savings, more than two times the average US household5 – How will these trends change Japanese spending habits? Big questions and clear opportunities - investors will be incentivized to sharpen their pencils and get on a plane to Tokyo and Osaka.

Under the Hood – Breaking Japan’s Market into quintiles:

We separate Japan’s nearly 3,900 listed stocks into segments that roughly relate to investor market cap mandates and trading turnover.1

Japanese midcap and small cap stocks have lagged large cap stocks 40-60% year-to date, and -25% and -46% on a one-year basis.6

We expect institutional and individual investors will look for more opportunities in the midcap and small cap space where there are investor mandates for those sizes. The absolute size of these top 3 quintiles is not large, but the ability to generate alpha in a corporate sector a) under public pressure to improve performance metrics, and b) experiencing upward profit potential from a resumption in profits with a very weak yen, will lead to profitable opportunities.

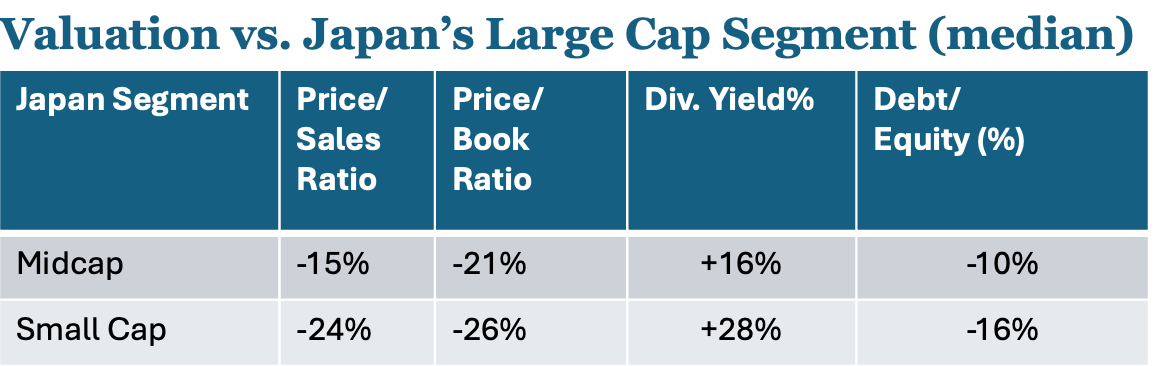

On a valuation basis, there is a notable gap vs. large caps – we focus on accounting-based trailing metrics given the lack of statistically significant estimates for smaller companies.6

From Value to Also Growth

Value investors have been driving Japan’s upward move since long before Warren Buffett began establishing Japan positions in 2019.7 Japan’s low price to book value ratios and large number of net cash companies will remain of interest. But as highlighted at the top, there is a list of under-covered and under-followed companies that have interesting growth potential, competitive niches, or unique business models that will likely be much more cash generative as Japan’s new economic cycle turns. Probable? Yes, with Japanese nominal GDP running a whopping 5% or more (vs. a 42-year average of 1.4% from 1980-2023)8, a shift to growth is in play, and look for growth companies to rise as investor sponsorship and research coverage rises.

From Growth Springs Financial Engineering to a New Wave of Equity & Debt Financing

We have looked at varying statistics and measures of Japan’s economic activity, profits, and financial securitization relative to other countries, and we conclude that Japan’s corporate financing business has been dormant over the course of three decades of deflation. With deflation, corporates and consumers alike are directly incentivized to hold onto cash to buy more when prices continue to decline. In other words: save more, spend less, be cautious about capital investment. But given rising nominal growth and record upward wage pressures9, generalized inflation now becomes a tax on excess cash savings.

Private equity has been making a more than twenty-year long investment in Japan, and according to McKinsey & Company, the number of disclosed private equity transactions has tripled to more than 150 vs. ten years ago.10 Investment banking business will also spring back as corporate reorganizations, management buyouts, and new expansion plans given Japan’s renewed role in technology, industrials, as a more vital consumer equipment will drive investor interest.

Our Favorite Drivers - Japan’s new role in investment hierarchy

Global investors have always found Japan vexing. When Japan last peaked in 1989, an estimated only 4% of Japan equities were owned by global institutional investors. That had increased to more than a 25% foreign ownership ratio by the time the Nikkei and TOPIX indices bottomed, a full 85% lower, in the early 2010’s => so Painful. Now, after a blistering rally, investor weightings in Japan are on the cusp of having a full weighting in Japan relative to benchmarks, a long-considered sell signal by the smart money, and the business media suggests investors will start taking profits.

It's funny, we used to show investors the “Annual Japan Pain Trade” showing a 15+year record of double-digit rallies in Japan’s TOPIX from January to May each year followed by an average 10% decline 70% of the time the remainder of the year. It was not scientific, but it did highlight a trend of nervous government window-dressing at each fiscal year (March) -year end amidst annual bank capital struggles and cross-held share selloffs.

That was then, but instead, investors should be looking at how much has changed –

Macro & Currency – Nominal GDP is up over 5% and and the yen has depreciated 47% from its 2012 peak and is back to late 1980’s levels.7 Not since the 1980’s has Japan appeared to have such positive backdrop for both domestic and international growth opportunities. While the yen is near forty-year lows vs. the USD, the dollar overall (DXY) is at a twenty-year high. A strong dollar is when US institutional investors should be allocating more to overseas markets which are cheap on a USD basis. Super US mega-market bull notwithstanding, asset allocators need to consider their international allocation although attractive choices seem limited.

Exposure to Asia is important for global portfolios - Asia’s share of global GDP is now 45% of total and running at about 70% of total global growth. Investors may find European values compelling but growth opportunities and weightings continue to push them to find opportunities in Asia. Investors continue to need to wrestle with their exposure to Hong Kong and China, and whether that is a cyclical or secular issue, investors are actively trying to reallocate to large liquid Asian markets of which there are only two choices, Japan followed by India. This is even occurring within China too, and we see data that Chinese institutional and retail flows into Japan equities and ETFs are very large.

Japan as Key Security and Reshoring Partner – Investors were long happy to ignore geopolitics in a globalizing world. Now, Wall Street refers to investing in a “multipolar world” which is a euphemism for how current geopolitics seriously constrains investment choices. The reality is that Japan is a preeminent security partner for the United States, and it is quickly becoming a key partner in forward US reshoring strategies, especially as an alternative semiconductor and technology component supplier. Japan is also likely to regain share that it lost to China in automobile components and industrial products given this trend and enhanced by the weak yen. In today’s world, this matters to investors, keeping allocations higher for longer.

Fallback in Fiscal Risk - Japan’s fiscal health will probably remain a concern of macro investors, but the end of its zero-interest rate policy and that Japan has defied the odds and continues to have positive external surpluses (due to investments rather than trade) are major positives.11 We believe Japan’s renewed role in Asia in an environment of inflation meaningfully reduces Japan macro risks or at least pushes them out.

Overall Japan Risks

After decades of nothing but, there are still different risks to the Japan story, but none of them seem close to the main scenario currently. The largest risk would be events that would recreate deflationary pressure in Japan – this could come from various sources such as a much larger deflationary pull down from China; or a large global recession that damages global consumer sentiment and corporate spending plans.

A second risk would be a catalyst that would tarnish the government’s drive to improve financial efficiency – a significant change in government leadership, for example, or a corporate action/event or financially destabilizing issue that could be used by non-reform factions (seemingly dormant now) of the government to pressure and reverse government reforms.

Overall, investors should avoid sweeping statements that there is a conclusive change in Japan that it is becoming “more capitalist”, or “more like the US market”. Governments and political parties as we can see everywhere take more than decades to evolve for sure. Rather, what we can say is that inflation is a definitive catalyst for better investment returns, and investors should like the way Japan is more aggressively using the market mechanism to generate those returns. And that is great news for a multi-polar world.

Patrick L. Springer is an institutional equities business developer with extensive experience working in the Japanese, US & Chinese securities markets. Patrick has a degree in Japanese language and Asian studies and worked at Morgan Stanley for more than twenty years helping investors navigate some of the world’s most challenging markets.

Citations:

1 Screening data from TradingView, some company fundamental data from Shared Research Japan (https://sharedresearch.jp/en)

2 McSkimming, Ross. "The Case for Japan Equities." Abrdn Investments, 19 Oct. 2022, www.abrdn.com/en-us/cefinvestorcenter/insights-thinking-aloud/article-page/the-case-for-japanese-equities#:

3 Ueki, H., CFA, CMA, & Kelly, M., CFA (2021, December 1). "The fish are biting: Exploiting Japan’s inefficient equity market". Retrieved February 20, 2024, from https://www.wellington.com/en/insights/japan-equity-market-inefficiencies-funds

4 Tokyo Stock Exchange (2024, January 15). Status of Disclosure on “Action to Implement Management that is Conscious of Cost of Capital and Stock Price”. Retrieved February 20, 2024, from https://www.jpx.co.jp/english/news/1020/o4sio700000059el-att/o4sio700000059lc.pdf

5 Statista.com (2023, August 30). Average amount of savings held by two or more person households in Japan from 2013 to 2022. Retrieved March 15, 2024, from https://www.statista.com/statistics/612538/japan-savings-two-person-households/#:~:text=As%20of%202022%2C%20average%20savings,million%20Japanese%20yen%20in%202013.

5 Knueven, L., & Acevedo, S. (2023, October 19). Average American savings balance by age, household size, and education level. Retrieved March 15, 2024, from https://www.businessinsider.com/personal-finance/average-american-savings

6 Stock price and data for quintiles from TradingView, as of March 12, 2024.

7 Langley, K. (2024, February 26). Warren Buffett Was There for the Japanese Market Rally. Retrieved March 19, 2024, from

https://www.wsj.com/finance/stocks/warren-buffett-was-there-for-the-japanese-market-rally-deb6315chttps://www.wsj.com/finance/stocks/warren-buffett-was-there-for-the-japanese-market-rally-deb6315c

8 CEIC Data (2024, January 31). Japan Nominal GDP Growth. CEIC. Retrieved March 15, 2024, from https://www.ceicdata.com/en/indicator/japan/nominal-gdp-growth#:~:text=Key%20information%20about%20Japan%20Nominal,Dec%202023%2C%20with%20172%20observations.

9 Tan, J. (2023, November 30). Firms in Japan raise wages by record amount in 2023. Retrieved March 15, 2024, from https://hrmasia.com/firms-in-japan-raise-wages-by-record-amount-in-2023/

10 Bischoff, C., Nozaki, D., Sato, Y., & Yoshikawa, S. (2024, January 1). A Force for Good: Japan’s Private Equity Opportunity. Retrieved March 13, 2024, from https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/a-force-for-good-japans-private-equity-opportunity

11 Kajimoto, T. (2024, February 7). Japan Dec current account surplus climbs but misses estimates. Reuters. Retrieved March 15, 2024, from https://www.reuters.com/markets/asia/japan-dec-current-account-surplus-climbs-misses-estimates-2024-02-08/