Stablecoins, the GENIUS Act, and the Future of Payments

Patrick L. Springer, Madison Place International Investors

OVERVIEW:

The passage of the GENIUS Act last week likely marks a watershed moment for the U.S. financial ecosystem. For the first time, the federal government has provided comprehensive regulatory clarity for stablecoins—a core building block of blockchain-based finance. This new legal framework gives legitimacy to digital dollars, allowing the private sector to lead innovation in a way that is both compliant and scalable.

The current size of the stablecoin market is estimated to be $260 billion in size, and institutions like Standard Chartered Bank are now estimating it may grow into a $2 trillion market by 2028*. As confidence in stablecoins grows, confidence in blockchain technology and blockchain (“Crypto”) assets will also increase, and institutions and corporations will expand the range of services and products that will drive innovation.

This commentary is written from the vantage point of someone who has seen the friction up close. A few years ago, I served as an advisor to a blockchain startup focused on asset tokenization for institutions. I later set-up a broker-dealer for an overseas investment bank, where I experienced firsthand how antiquated, expensive, and closed the existing financial securities settlement systems are, particularly for new entrants. Despite all the promise of blockchain technology, the regulatory uncertainty and resistance from incumbent players have long kept serious institutional capital at bay.

The GENIUS (“Guiding and Establishing National Innovation for U.S. Stablecoins”) Act changes that regulator uncertainty and incumbent technology resistance, the latter most especially from bank and credit card companies.

Here’s why it matters - and what is likely to come next.

1. Regulatory Clarity Unlocks Institutional Adoption

Until now, stablecoins operated in a regulatory gray zone. Some, like Circle’s USDC, were licensed under state regimes such as New York’s BitLicense. Others had no formal oversight. Federal regulators had not agreed on what a stablecoin is, who can issue one, or how reserves should be managed.

The GENIUS Act ends that uncertainty by:

- Defining a new legal category: "Payment Stablecoins"

- Creating licensing and regulatory certainty: all types of private companies can issue stablecoins, but they must be licensed and regulated by either the OCC, the Federal Reserve, the FDIC, OR by states that establish compliant supervisory regimes and want to lead in this space.

- Mandating reserves: Each token must be backed 1:1 by liquid U.S. assets (e.g., cash, T-bills)

- Creating transparency: Monthly reserve attestations and regulator exams are now required. The Act includes anti-money laundering rules and various consumer protections.

Importantly, the Act bars the Federal Reserve and other government agencies from issuing a retail Central Bank Digital Currency (CBDC). That role is left to the private sector—a major philosophical and strategic difference from models being pursued in China and parts of Europe. Overall, this regulatory clarity provides institutional investors with a predictable, rules-based environment.

2. Safer Playing Field for Banks, Fintechs, and Corporates

By mandating full reserve backing and redemption guarantees, the Act creates what might be called the "Circle or PayPal standard" across all issuers. Full reserve backing - and the explicit prohibition of algorithmic mechanisms - will help prevent a repeat of the TerraUSD-style collapse in 2022. Counterparties and consumers will increasingly come to trust that compliant stablecoins are safe to use and redeemable at par.

This opens the door for:

- Banks to integrate stablecoins into treasury and settlement processes

- Fintechs like PayPal, Square, or Apple to offer seamless digital dollar services

- Retailers to launch loyalty and payment programs using programmable digital dollars

3. A new De-risked Infrastructure will stimulate Institutional Investors and Asset managers

More than just legalizing stablecoins, it signals to banks, investors, and corporates that financial and legal guard rails will be safe and regulated, which means scalable. With regulated stablecoins, they can be used in remittances and cross-border B2B payments.

As financial institutions and investment managers gain confidence in stablecoins, they can begin holding more assets directly on-chain which allows them to unlock benefits such as:

- instant settlement

- 24/7 transfers

- the elimination of wire delays and bank cut-off times.

Smart contracts - which enable automated interest payments and programmable asset terms - are poised to go mainstream, driving rapid adoption of tokenized asset platforms. This creates significant opportunities for scaling private equity and private credit investments and transactions.

Use cases now viable at scale include:

- Treasury management: Holding USDC or similar tokens as a near-cash instrument

- Treasury diversification: Corporates can hold yield-bearing tokens backed by short-term T-bills (like BlackRock BUIDL + USDC).

- Blockchain-based fund creation and facilitation: GPs and LPs can use regulated stablecoins for subscriptions, redemptions, and NAV settlement

- NAV settlement: Using stablecoins for LP subscriptions, redemptions, and capital calls

- Tokenized real-world assets: Settling tokenized real estate, credit, or fund products with compliant digital dollars

This unlocks a significant pipeline of innovation for capital markets. In short: stablecoins are no longer niche financial instruments. They are emerging as enterprise-grade tools for modern digital finance.

4. The First Battlefield: Stablecoins vs. Credit Cards & Remittances

It is evident that debates about stablecoins are becoming more complicated now that one political party is identified with its development vs. another. But investors should remain non-partisan in their investment strategies and focus on technological progress, efficiency, and the age-old drive to lower costs.

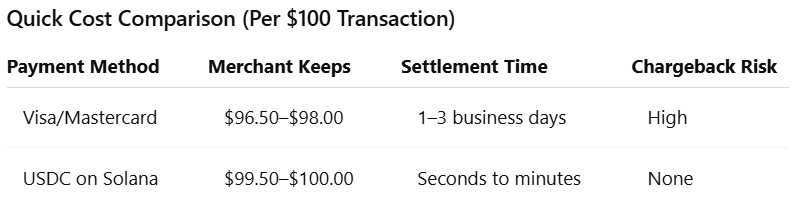

One of the most compelling aspects of stablecoins is cost efficiency. Traditional card networks—Visa, Mastercard—charge vendors 2.0% to 3.5% per transaction. That includes:

- Interchange fees to the issuing bank

- Assessment fees to the network

- Processing fees to intermediaries like Stripe or Square

Stablecoin transactions can cut those costs to near zero:

- Blockchain “gas” or transaction fees” can be under $0.01 (especially on blockchain systems that support fast, low-cost settlements such as Solana & Polygon)

- No interchange, chargebacks, or assessment fees

- Funds settle in seconds—not days

Consumers may be agnostic for the time being, but for merchants and platforms, this is a game changer. The same goes for the consumer overseas remittance market.

5. Visa and Mastercard Investments Verify the Opportunity

Notably, stablecoins are being validated by the companies that are most likely to be disrupted by them. Visa and Master Card are accelerating their investments of the past 4 years in the stablecoin payments structure because they must avoid being disintermediated. Both Visa and Mastercard are adapting to the new stablecoin landscape. Everything is moving fast, but Visa’s strategy appears to be to ensure that they are a core part of the evolving stablecoin payment system. This includes:

· Settling cross-border transactions in USDC on Ethereum and Solana

· Powering merchant acceptance through crypto wallet APIs

· Experimenting with programmable smart contract-based payments

Mastercard has also developed a strategy to be a key part of the stablecoin settlement system with actions such as:

· Building a Multi-Token Network (MTN) for stablecoins, CBDCs, and tokenized deposits

· Launching Crypto Credential programs to verify blockchain-based transactions

· Partnering with Circle and Paxos on pilot programs for stablecoin use at point of sale

Investors are in different lanes about how the incumbents will succeed in the world of stablecoins, but their actions verify the opportunity.

6. Forward Hurdles and Opportunities

Even with a regulatory regime in place, more than a few adoption hurdles remain:

Consumer familiarity: Stablecoins are not yet as intuitive as swiping a card

Merchant tooling: Integration into accounting, tax, and POS systems is ongoing

On/off ramps: Converting from fiat to digital dollars and back is improving, but not yet frictionless everywhere

But perhaps the biggest hurdle, that of legal uncertainty, has now been eliminated. And most encouraging, the GENIUS Act validates the role of the private sector in building the blockchain-based financial infrastructure. It invites banks and institutions to participate safely. And it creates the conditions for real-world use cases that can lower costs, increase transparency, and improve settlement speed across the financial system. Inevitably there will be bad actors that always try to take advantage of disruptive moments, but the US has created the first national framework for the private sector to lead the development of the digitalized payment and transaction world.

* https://www.reuters.com/business/finance/stablecoins-step-toward-mainstream-could-shake-up-parts-us-treasury-market-2025-06-06/

Patrick L. Springer / PatrickLSpringer@MadisonPlaceIntl.com